RDF | Rebooting The Philippines Swine Industry: Challenges, Prospects, and Policy Directions

As one of the thought leaders in the animal industry, Dr. Robert H. Lo was invited by the Department of Agriculture to deliver a paper on the Swine Industry in the Philippines at the National Agri-Fishery Investment Forum on September 16, 2025, held at the Palacio de Maynila in Malate, Manila. The forum was attended by local government units nationwide. Dr. Lo is the Founder and CEO of RDF, Feed, Livestock & Foods, Inc., an agri-food enterprise, which is based in Pampanga in Central Luzon, Philippines.

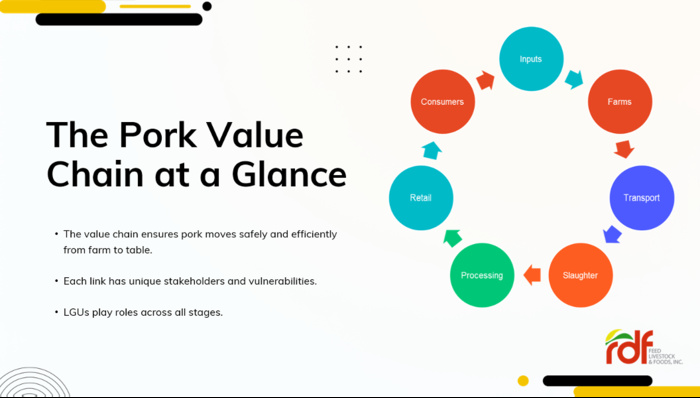

Dr. Lo began his presentation with the Pork Value Chain and discussed at length the local swine industry’s present situation, highlighting challenges and opportunities. During the Q&A segment of the forum, he outlined some recommendations on how the government can help the industry become more competitive and more profitable for industry players.

The swine industry is one of the pillars of Philippine agriculture, valued at around ₱191 billion. It is the largest animal industry and second only to rice in agricultural contribution. Pork remains the country’s top source of animal protein and a staple in Filipino culture, from everyday meals to fiesta lechon, while sustaining millions of small farmers, traders, and workers.

In recent years, however, the sector has faced its most formidable challenge: African Swine Fever (ASF). Since its 2019 outbreak, ASF has wiped out millions of pigs, forced farm closures, and driven pork prices to historic highs. Coupled with pandemic disruptions, the industry remains in crisis and is still struggling to recover.

This makes it crucial to understand the swine industry’s current state, its challenges, and the opportunities and policy directions that can shape its future.

The Current State of the Industry

A Key Economic Driver

Despite the setbacks of the past few years, the swine industry remains a vital part of the economy. It contributes the highest share of output among livestock and poultry sectors in terms of both volume and value. In fact, hog production provides about 60% of the total animal meat consumed by Filipinos.

The industry also supports employment. Over 2.8 million Filipino farmers depend on livestock and poultry production for their livelihood, and pork continues to dominate the Filipino diet.

However, beneath these headline figures lies a production system still heavily dependent on smallholders, which has significant implications for competitiveness and resilience.

Backyard vs. Commercial Production

As of 2025, 71.1% of hogs are in backyard farms, 26.1% in commercial farms, and 2.8% in semi-commercial farms, showing the dominance of smallholders. Commercialization has been rising, from 18% in 1994 to 29% by 2021, led by CALABARZON and Central Luzon.

This gradual shift has influenced both production volumes and market supply, which in turn reflect broader consumption and demand patterns.

Production and Consumption Trends

Before ASF hit, hog production steadily increased, reaching over 2.3 million metric tons in 2018. From 2017-2018, hog inventory grew by 31%, but the ASF outbreak (2019 onwards) caused a sharp -33% decline in the national swine population by 2025. By late 2021, the national hog inventory had fallen to just 9.7 million heads, down from 12.8 million in 2020.

Despite this, pork remains the top meat choice of Filipinos. Per capita consumption reached as high as 16.22 kilograms in 2018 before declining due to ASF and the pandemic. Still, demand is robust and expected to grow alongside the population and the expanding food service industry.

To understand where production is concentrated, it is also essential to look at the regional picture.

Regional Production

As of Q1 2025, CALABARZON, Central Luzon, and Northern Mindanao account for 34% of the national hog inventory. Their strengths, like proximity to Manila (for CALABARZON and Central Luzon), better infrastructure, and cheaper feed inputs, position them to lead recovery despite ASF impacts.

Prices and Imports Filling the Gap

ASF-driven shortages pushed live hog prices to a record ₱254.49/kg in March 2025. With local supply unable to keep up, pork imports surged over 550,000 MT in 2021 and are trending 30% higher in 2025, stabilizing supply but undermining local producers.

Challenges Facing the Swine Industry

The current dynamics reflect multiple challenges weighing down the Philippine swine industry—these range from disease outbreaks to structural and economic hurdles.

- ASF outbreaks have wiped out over six million pigs since 2019, with recovery slow for backyard raisers who lack capital.

- High feed costs, which account for 65-75% of production, remain among the highest in Asia due to reliance on imported corn and soy.

- Other diseases (PRRS, hog cholera, PED) persist, particularly in backyard farms with weak biosecurity.

- Climate and land pressures from typhoons, extreme heat, and urbanization limit viable hog-raising areas and complicate waste management.

- Smuggling and import dependence undermine local prices and discourage expansion.

- Weak smallholder capacity, with backyard raisers lacking financing, technology, and training, leaves them vulnerable to losses and market downturns.

Prospects and Opportunities

Despite challenges, the swine industry has strong prospects. Pork demand is expected to rise steadily with population growth of over one million people annually and the expansion of the food service sector.

Recovery will also hinge on the ASF vaccine rollout. The Philippines began pilot vaccinations in 2024, starting with 10,000 doses and expanding distribution. In parallel, border inspection facilities (CEFA) are being built to tighten biosecurity and prevent reinfections. Together, these measures could allow gradual herd repopulation and stabilize supply.

Niche markets are another opportunity. Native pigs remain in high demand for lechon and specialty markets seeking healthier, antibiotic-free pork. These hardy breeds thrive in smallholder and island settings with minimal inputs.

Private sector investments are also accelerating modernization. Large firms and feed companies are offering training, financing, and improved genetics to backyard raisers.

The trend toward commercialization strengthens long-term competitiveness. The steady growth of commercial operations, especially in CALABARZON and Central Luzon, points to a shift toward larger-scale, more efficient production. Commercial farms benefit from economies of scale, better genetics, and integrated value chains, setting the foundation for a stronger and globally competitive industry.

Policy Recommendations for a Competitive Industry

To make the swine industry more profitable for players and globally competitive, government policy and planning must address both immediate recovery and long-term modernization. This requires a paradigm shift, recognizing that the Philippines is first and foremost an agricultural country, and crafting policies and investments that prioritize food production and farmers’ security.

1. Repopulation and Clustering

The Department of Agriculture (DA) targets adding two million hogs annually until 2028, with clustering of smallholders into co-ops or defined zones for stricter biosecurity.

Other countries affected by ASF, such as China and Vietnam, have rebuilt their supply chains by constructing large-scale modern farms. The Philippines can adopt similar strategies, adapting them to include smallholders through clustering. Ensuring a stable land base is also vital; without a clear national land use law, farmlands are vulnerable to land conversion. More vigorous enforcement of LGU requirements to reserve land for agriculture is necessary to secure the food production zones.

By 2028, the aim is not just to restore herd numbers but to build a stronger, safer, and more competitive industry through clustered systems less prone to disease spread.

2. Ensuring Feed Security

Feed security requires boosting local corn production through better seeds, post-harvest facilities, and credit, while expanding the use of alternative ingredients like banana meal, copra meal, and molasses. Mindanao’s abundant agro-industrial by-products offer strong feed alternatives, while Luzon and Visayas should also be integrated into a regional value-chain approach.

Lowering feed costs to 50-60% of total production, as achieved in countries like Thailand and the U.S., would significantly improve the competitiveness of Filipino pork. Government investment in water impounding and irrigation facilities is also crucial to stabilize feed crop supply year-round, reducing seasonal shortages and reliance on imports.

3. Strengthening Veterinary Health Systems

The ASF vaccine rollout must be paired with clear protocols, ASF-free zones, and stronger surveillance of both commercial and backyard farms. Border controls, such as Cold Examination Facility in Agriculture (CEFA) at all major ports, should be fully operational by 2025, modeled after Japan and Taiwan’s strict systems. Meanwhile, local veterinary services require additional personnel, training, and lab support.

4. Supporting Backyard Farmers

Backyard raisers should be integrated into value chains through contract growing or clustering, supported by credit guarantees and insurance. To ensure financing truly reaches farmers, strict implementation of the Agri-Agra Reform Credit Act is necessary. Streamlined, one-application systems for government credit, insurance, and support programs would also make assistance more accessible and reduce bureaucratic delays. The ultimate goal is to raise backyard farm productivity closer to commercial standards, ensuring that smallholders remain competitive and contribute significantly to the national pork supply.

5. Investing in Infrastructure

Upgrading AAA-grade abattoirs, expanding the cold chain (storage, transport, and display), and building a National Pork Traceability System are key infrastructure needs. Improvements in farm-to-market roads and biosecure inter-island logistics would lower transport costs, reduce spoilage, and open new export opportunities.

At the same time, market access plans long promised by the government must be executed, linking hog raisers to institutional buyers, processors, and export channels. Streamlining these linkages will ensure farmers capture more value from their production.

Together, these investments would modernize the industry and strengthen its long-term competitiveness.

From Crisis to Competitiveness

The Philippine swine industry stands at a crossroads. It faces steep challenges from ASF, high production costs, and the fragility of backyard farms. Yet, it also has strong cultural demand, private sector support, and new opportunities like the ASF vaccine and niche markets.

With coordinated action, including repopulation, feed security, farmer support, infrastructure, and research, the industry can recover and thrive. The goal is clear: a sustainable, resilient, and globally competitive hog sector that secures livelihoods, strengthens food security, and keeps pork on the Filipino table.

The moment calls for bold policies, strong partnerships, and shared commitment so the swine industry doesn’t just survive, but prospers for generations to come.